Back

Our Assumptions and Methodology

OBJECTIVE

The primary objective of this calculator is to help provide education on how current retirement savings and estimated future contributions may help to satisfy estimated income needs in retirement. Through the six basic questions, we gather general information about a hypothetical scenario and roughly estimate how that scenario may perform over time. The results offered by the calculator are not intended to be investment advice or recommendations regarding your retirement planning based on your personal situation, and you should not rely on the calculator to make your retirement planning decisions. The calculator is not a substitute for a retirement plan. The calculator’s results regarding the hypothetical accumulation of assets are based on a set of growth rates for various time horizons. These rates have been generated through simulations based on historical market data to consider the probabilities a portfolio might experience under different market conditions, although the market's past performance does not predict how it will perform in the future. The calculator provides results based on how an asset allocation similar to your asset allocation (or the target asset mix you select) performed in various market scenarios. In addition, the calculator incorporates a number of assumptions, some of which, such as life expectancy, may be conservative.

We encourage you to take control of your own retirement planning situation and expectations by building a sound plan based on details of your personal situation, time horizon, risk tolerance, and goals.

The projections or other information generated by Fidelity's planning tools or calculator regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time.

Any data you have included in this calculator will not be stored or used in any subsequent Fidelity planning calculator or calculator session.

LIMITATIONS OF THE CALCULATOR

It is important to remember that the calculator is not intended to project or predict the present or future value of actual investments or actual holdings in your portfolio (or a selected allocation) or actual lifetime income. Also, the calculator should not be used as the primary basis for any investment or tax-planning decisions. This calculator makes no assumptions about taxes and displays all results in gross (before tax) format. The retirement income estimates provided by the calculator are generated through simulations based on an analysis of historical market data. The analysis considers the probabilities that certain asset mixes might experience under different market conditions. The calculator assumes a level of asset-class diversity that is consistent with a specific market index. Volatility of the stock, bond, and short-term asset classes is based on the historical annual data from 1926 through the most recent year-end data available from Ibbotson Associates, Inc. Stock (domestic and foreign), bond, and short-term asset classes are represented by the S&P 500® Index, U.S. intermediate-term government bonds, and the 30-day U.S. Treasury bill, respectively. Annual returns assume the reinvestment of interest and dividends, no transaction costs, and no management or servicing fees. It is not possible to invest directly in an index. All indexes include the reinvestment of dividends and interest income. All calculations are purely hypothetical and will not affect your actual accounts. The historical performance analysis is intended only to be one source of information that may help you assess your retirement income needs. The calculator uses a set of income replacement targets for estimating the retirement income need. These income replacement targets are based on Consumer Expenditure Surveys (Bureau of Labor Statistics), Statistics of Income Tax Stat, IRS tax bracket, and Social Security estimates. The national spending data were analyzed across a salary range of $50,000–$300,000; therefore, this calculator may have limited applicability if your income is outside that range. Remember that past performance is no guarantee of future results. Performance returns for actual investments will generally be reduced by fees or expenses not reflected in these hypothetical illustrations. Returns also will generally be reduced by taxes.

HOW CALCULATIONS WORK

The first part of the process is to estimate assets at retirement. This calculator uses a set of growth rates generated by an asset liability modeling engine that estimates the likelihood of a particular outcome based on an analysis of historical market data.

The asset projection is based on four data items derived from information provided by you:

- Existing retirement savings you entered

- Monthly savings amount indicated (we assume you save and invest the same amount every month until retirement age)

- Asset allocation (one of the 9 asset mixes / investment styles, from all cash to all stocks)

- Years to retirement

Estimated projected assets are calculated using two tables generated by our asset liability modeling engine. Estimating assets at retirement requires calculating the number of $1 units of initial balances and the number of units of $1-per-year contributions.

The first table is a table of projected future balances per $1 invested today (the amount you indicated in "retirement savings"). Thus, $1 is the unit value for initial balances. The table contains projected values (in today’s dollars) for investment periods from 1 year to 50 years for each potential asset, mix in underperforming market conditions.

The second table is a table of projected values from future contributions of $1 per year. Thus, $1 is our unit value for contributions. The table contains projected values (in today’s dollars) for investment periods from 1 year to 50 years for each potential asset mix, in underperforming market conditions. We assume that the contribution amount (and salary) grows at a rate of 1.5% (as explained in more detail below). A total asset balance is calculated for each dollar of retirement savings and annualized contributions. This balance is then annuitized from the selected retirement age to the plan age using a discount rate of 4%. This income stream is then combined with Social Security estimates to calculate the “you may have” retirement income.

Underperforming market conditions mean that in 9 out of 10 market scenarios, the hypothetical portfolio performed at least as well, while 1 out of 10 times, the hypothetical portfolio failed to perform as well. Today’s dollar values illustrate how a current asset or expense could grow over time in real terms. These values are inflation-adjusted and do not need to be discounted by any projected inflation estimates.

The second part of the process is to estimate replacement income in retirement. To estimate the amount of replacement income one might need in retirement, the calculator assesses the preretirement income for the user and defaults to a replacement value of that preretirement income. The calculator uses a set of income replacement targets for estimating the retirement income need. These income replacement targets are based on Consumer Expenditure Surveys (Bureau of Labor Statistics), Statistics of Income Tax Stat, IRS tax bracket, and Social Security estimates. The national spending data were analyzed across a salary range of $50,000–$300,000; therefore, this calculator may have limited applicability if your income is outside that range. The income replacement target may then be adjusted up or down by a factor of 15% depending on the option selected by the user.

To generate the value of preretirement income, salary entered by the user is grown at a real rate of 1.5%. The 1.5% increase is based on the analysis of data of salaries from various sources, including data from the Department of Labor and the U.S. Census Bureau. Finally, the preretirement income is multiplied by the income replacement target to generate an estimate of “you may need” retirement income need in today’s dollars. The subsequent expenses after the first year of retirement are assumed to stay constant in real terms or today’s dollars. Today’s dollar values illustrate how a current asset or expense could grow over time in real terms. These values are inflation-adjusted and do not need to be discounted by any projected inflation estimates.

FACTORING IN SOCIAL SECURITY INCOME

To take into account the impact of Social Security income on your goal amount, we have made certain assumptions that you should consider in analyzing your hypothetical results. The calculation assumes that you will be eligible to collect Social Security benefits and will have a full working history. Additionally, no tax consequences for Social Security benefit amounts are taken into account. All calculations are gross of taxes.

The calculator assumes that Social Security is based on a single benefit from the salary amount indicated. Therefore, this snapshot should be used only for analysis on an individual basis.

First, your entered salary amount, current age, and retirement age are used to determine your preretirement income estimate. Then, Social Security income is estimated based on that preretirement income estimate. The estimate is not affected by account balances, contribution rates, or asset mix; market conditions do not affect the calculation of potential Social Security income. The estimate is affected by salary growth. So, if an individual experiences a different salary growth rate than the calculator assumes, the Social Security benefit may be different. Social Security retirement benefits are adjusted by the application of a cost-of-living adjustment (COLA) increase defined in a federal legislative enactment. Finally, the Social Security benefit is reduced or increased if the retirement age is less than or greater than 67, respectively.

Please note that your actual Social security benefit is calculated with a more precise look at current age in month and year as well as actual earnings. To understand your actual benefit amount, please visit www.ssa.gov.

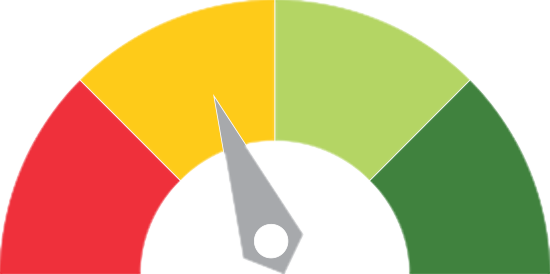

FIDELITY RETIREMENT SCORE

The Fidelity Retirement Score estimates the percentage of a retirement income goal that a user or household is estimated to replace in underperforming market conditions. Or in other words, the retirement score is obtained by dividing the “you may have” retirement income estimate by the “you may need” estimate. The score is visually displayed within a dial, which is segmented by Fidelity’s assessment of the score.

The retirement score breakdown is as follows:

| Score |

Assessment |

| <65 |

Significant adjustments to plan are required to sufficiently cover your estimated retirement expenses in an underperforming market |

| 65–80 |

Modest adjustments to plan are required to sufficiently cover your estimated retirement expenses in an underperforming market |

| 81–95 |

On track to cover most of your estimated retirement expenses in an underperforming market |

| >95 |

On track to cover 95% or more of your estimated expenses, even in an underperforming market |

ASSUMPTIONS WITHIN THE CALCULATOR

End of Retirement / Planning Age — Planning age is the age your retirement plan ends. The calculator uses this age to figure out how many years your retirement plan needs to generate income. You can choose an age from 85 to 100 as the end of your retirement. This will affect how much you will have, and consequently change your score. The default planning age used in the calculator is 93. This default is by assuming an estimate of the age at which 25% of healthy individuals who reach age 65 are projected to still be living (or, conversely, the age by which 75% of such individuals would be deceased). This figure is called a 25% longevity age. The source for this estimate is the 2014 Individual Annuitant Mortality Table, provided by the Society of Actuaries.

Inflation Rate — All the rates and cash flows in the calculator, including investment growth rates, Social Security income, salary growth, and retirement spending, are in real terms or today’s dollars. Today’s dollar values illustrate how a current asset or expense could grow over time in real terms. These values are inflation-adjusted and do not need to be discounted by any projected inflation estimates. Therefore, no explicit assumption for an inflation rate is needed for this analysis.

Salary Growth — The assumed rate is 1.5% in real terms. This figure is derived from the analysis of data of salaries from various sources, including data from the Department of Labor and the U.S. Census Bureau.

Income Replacement — The calculator assumes a range of income replacement targets that use an assumption that spending patterns in retirement vary by preretirement income. Households or individuals with significantly higher preretirement income may not need to replace as much of their preretirement income as compared with the households or individuals with lower preretirement income. These income replacement targets are based on Consumer Expenditure Surveys (Bureau of Labor Statistics), Statistics of Income Tax Stat, IRS tax bracket, and Social Security estimates. The national spending data were analyzed across a salary range of $50,000–$300,000; therefore, this calculator may have limited applicability if your income is outside that range.

Lifestyle Adjustment — The income replacement analysis is based on the objective that households should be able to maintain the same spending or lifestyle they were enjoying before retirement. However, the idea behind the lifestyle question is to help us understand how much you think you'll spend in retirement relative to other people who have approximately the same amount of preretirement household income. Choose "Average" if you think you'll spend roughly the same amount as we estimate you spend now. By the same token, choosing "Below Average" means you plan on spending approximately 15% less, while choosing "Above Average" means you think you'll spend about 15% more. Some examples of why you may spend “below average” are that you have prepaid your mortgage, you no longer financially support your children, or you have eliminated substantial work-relate expenses like commuting, eating out, work clothes, etc. Similarly, you might spend “above average” if you are planning to have a more active lifestyle with substantially higher spend on travel and entertainment.

Asset Allocation — The 9 different target asset mixes available in the calculator are shown in the chart below.

Fidelity has created nine target asset mixes based on historical risk and estimates of long-term asset class returns. They represent nine significantly different allocations that are intended to reflect differing investor profiles with varying investment objectives and risk tolerances, as well as investment styles ranging from conservative to aggressive.

| |

Asset Class |

| Target Asset Mix | Domestic Stocks | Foreign Stocks | Bonds | Short Term |

| Short Term | 0% | 0% | 0% | 100% |

| Conservative | 14% | 6% | 50% | 30% |

| Moderate with Income | 21% | 9% | 50% | 20% |

| Moderate | 28% | 12% | 45% | 15% |

| Balanced | 35% | 15% | 40% | 10% |

| Growth with Income | 42% | 18% | 35% | 5% |

| Growth | 49% | 21% | 25% | 5% |

| Aggressive Growth | 60% | 25% | 15% | 0% |

| Most Aggressive | 70% | 30% | 0% | 0% |

| |

Asset Class |

| Target Asset Mix | Domestic Stocks | Foreign Stocks | Bonds | Short Term |

| Short Term | 0% | 0% | 0% | 100% |

| Conservative | 14% | 6% | 50% | 30% |

| Moderate with Income | 21% | 9% | 50% | 20% |

| Moderate | 28% | 12% | 45% | 15% |

| Balanced | 35% | 15% | 40% | 10% |

| Growth with Income | 42% | 18% | 35% | 5% |

| Growth | 49% | 21% | 25% | 5% |

| Aggressive Growth | 60% | 25% | 15% | 0% |

| Most Aggressive | 70% | 30% | 0% | 0% |

When you select an asset mix, keep in mind that different asset classes tend to offer different balances of risk and reward. Generally, the greater the potential for long-term returns, the greater the risk volatility, especially over the short term. In order to help control the risk you assume, it is critical that your portfolio provides an appropriate mix of investments. A more aggressive portfolio (one with a higher stock allocation) could represent higher risk, especially in the short term, but higher potential long-term returns. Conversely, a less aggressive portfolio (with a lower allocation to stocks and a higher allocation to bonds or short-term investments) could represent less short-term risk but potentially lower long-term returns. You should take into consideration any unique circumstances or need for funds that might apply to your situation when deciding on an appropriate investment strategy.

Investment Growth — The retirement income estimates provided by the calculator are generated through simulations based on an analysis of historical market data and presented for underperforming market conditions. Underperforming market conditions mean that in 9 out of 10 market scenarios, the hypothetical portfolio performed at least as well, while 1 out of 10 times, the hypothetical portfolio failed to perform as well.