The Charitable Giving Strategy Worksheet

Timely strategies to help you give and save more

Timely strategies to help you give and save more

Questions to Consider:

- Are you planning to give to charity on an annual basis?

- Do you want to increase your itemized deductions to surpass the standard deduction?

- Are you expecting a high-income year, which could move you into a higher marginal income tax bracket?

- Do you own long-term appreciated securities in a taxable account?

Approaches to Consider:

- Bunch your giving: Contributing multiple years of giving upfront may help you enhance your tax savings. You may want to consider this strategy if you are facing a high-income year, nearing retirement or looking to exceed the standard deduction.

- Think beyond cash: You may be able to increase your charitable impact by giving long-term appreciated securities (e.g., stocks, bonds, mutual funds and non-publicly traded assets like private business interests) to charity. Compared to giving cash, or selling the appreciated securities and contributing the proceeds, giving appreciated securities may enable you to reduce your tax liability.

- Use a donor-advised fund: A donor-advised fund like the Fidelity Charitable® Giving Account® may enable you to support your favorite charities while helping you take advantage of the tax-planning strategies above. Contributing to a public charity sponsoring a donor-advised fund program provides an immediate tax deduction and provides you, the donor, the flexibility to recommend grants to charities at your own pace. While you decide which charities you would like to recommend grants to support, your contribution may be able to grow tax-free utilizing an array of investment options.

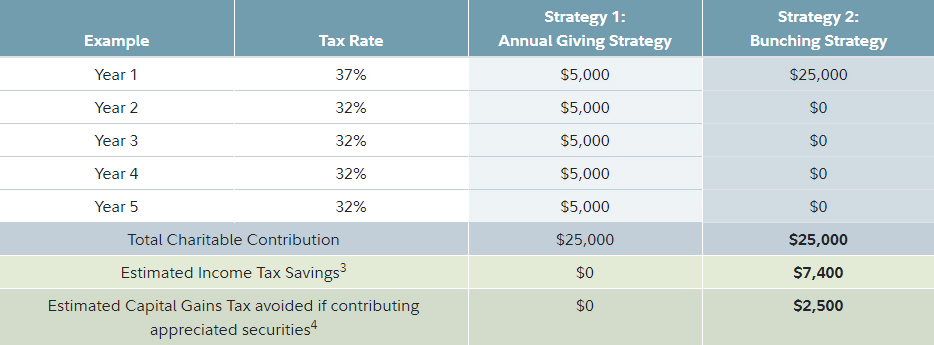

Here's a Hypothetical Example:1

Anne, a single / individual tax filer, typically gives $5,000 to charity each year. She expects to claim an additional $9,600 in other itemized deductions.2 Due to a sizable bonus this year, Anne thinks she will be subject to a higher income tax rate.

- Strategy #1 shows Anne's estimated tax savings if she continues to give $5,000 annually in cash. Even with other itemized deductions, Anne is unable to exceed the standard deduction of $14,600 and will not receive any additional tax savings.

- Strategy #2 shows Anne's potential tax savings if she gives five years’ of charitable contributions in this high-income year. By giving the full amount in long-term appreciated securities from her taxable account, Anne eliminates the capital gains tax and enjoys significant income tax savings. If she uses a donor-advised fund, these assets may grow over time—tax-free—and increase her charitable impact.

1 For illustrative purposes only. Based on 2024 federal income tax rates and deductibility limits, which are subject to change.

2 Popular itemized deductions include charitable contributions, mortgage interest deduction, medical / dental expenses, and state / local taxes.

3 Assumes adjusted gross income (AGI) of $650,000 in year 1 and $200,000 for years 2-5.

4 Assumes gift of long-term appreciated stock, capital gains tax rate equal to 20%, and cost basis equal to $12,500.

If you would like to review your charitable giving in context with your broader financial plan, please speak with your financial advisor.

The Charitable Giving Strategy Worksheet

Evaluate how much to give

The Charitable Giving Strategy Worksheet

Evaluate which assets to give (securities vs. cash)