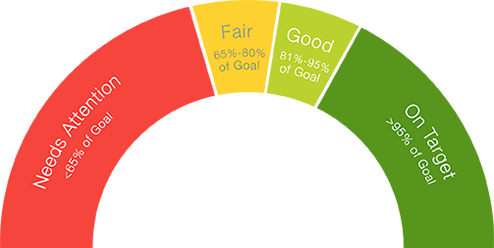

The Fidelity Retirement ScoreSM

Know where you stand for retirement in just 60 seconds. Answer 6 simple questions to get your score and additional steps to consider as you save for retirement.

Explore your IRA options

See which IRA might be right for you. You can manage your investments yourself, with no account fees or minimums1, or have us do it for you for an advisory fee2.

Open An IRA1No account fees or minimums to open Fidelity retail IRA accounts. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs), and commissions, interest charges, and other expenses for transactions, may still apply. See Fidelity.com/commissions for further details.

2Optional investment management services provided for a fee through Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser and a Fidelity Investments company. Discretionary portfolio management provided by its affiliate, Strategic Advisers LLC, a registered investment adviser. These services are provided for a fee.

Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. FPWA, Strategic Advisers, FBS, and NFS are Fidelity Investments companies.

HOME

HOME